What Will happen to UK House Prices in 2025

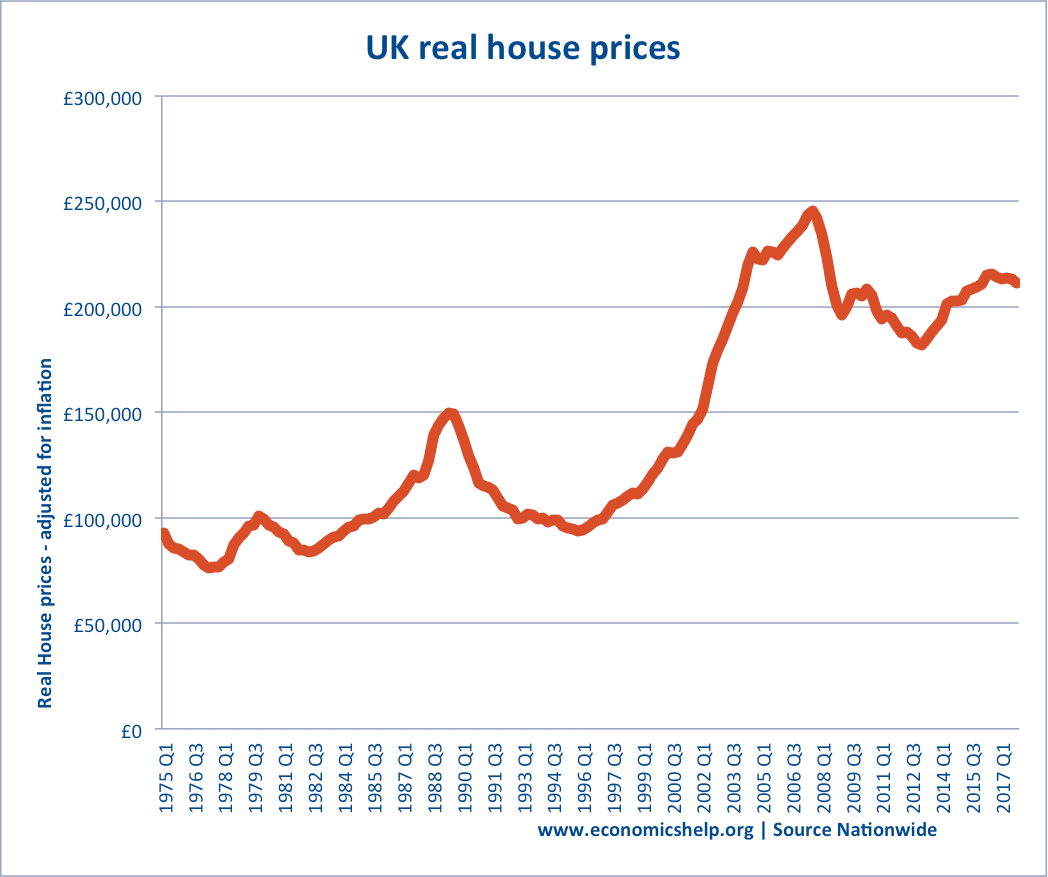

2024 has seen UK house prices seamingly defy gravity once more, with prices rising back close to the all-time peak. If you bought an average house at the start of 2020, you would be sitting on capital gains of £53,000. A 25% rise. What Will happen to UK House Prices in 2025?Watch this video on …